Whitepaper March 2025

Tokenized Energy’s co-founders believe that the Fourth Industrial Revolution is underway – that the physical world is being digitally transformed, with blockchain technology as the enabler. The increasing tokenization of real world assets, commonly referred to as bringing assets “on chain”, is a trend with legs.

We believe that tokenization is a long term trend – why? Primarily because tokenization’s attributes lead to process efficiencies, cost savings and composable assets that are vastly superior to those associated with traditional finance. Tokenization characteristics include the following:

Much Lower Cost; cut out “toll collectors

Transparency re: ownership/governance

Settlement/closing efficiency via automation

Enhanced liquidity

Expanded access across geography, time 7/24/365 & investor class by fractionalization

Composability of tokenized assets create tokens for use in Defi Collateral. liquidity on a Dex)

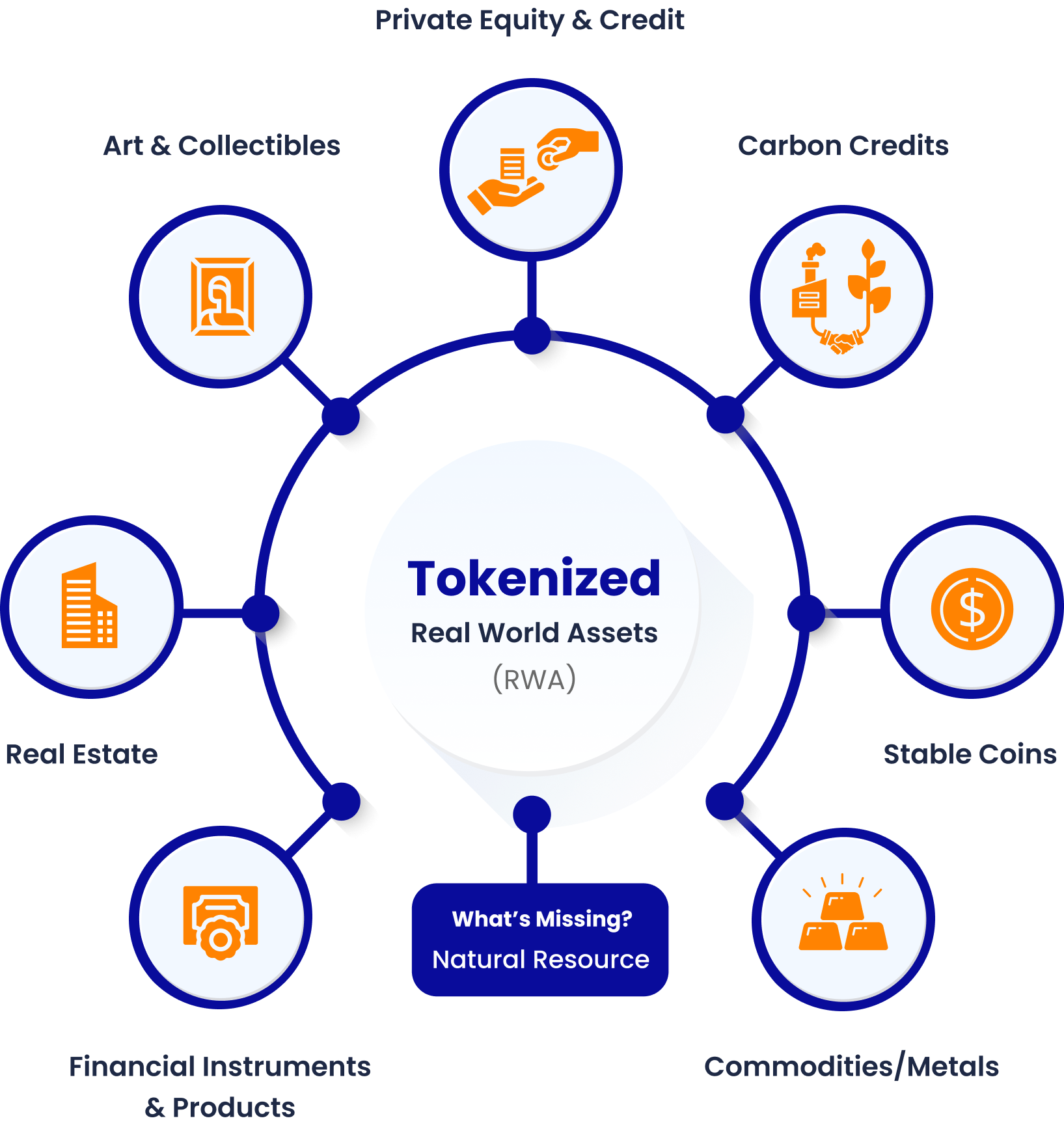

Tokenizing real world assets is already occurring in multiple asset classes, more predominantly by dollar volumes in the arena of financial products (stablecoins, US Treasuries, private credit, stocks and bonds, etc.), but also in other asset classes like real estate and commodities. The natural resources sector, in particular upstream oil and gas assets, the area of our expertise and experience, is significantly under-developed from a tokenization perspective compared to others

Investing in high quality upstream oil and gas assets is a complex process with restricted access to a relatively limited number of industry participants, many of whom can only acquire new assets by acquiring the entirety of the identified opportunity (with the other interested bidders for those assets leaving with nothing).

Leveraging Tokenization to Streamline Ownership and Collaboration in the U.S. Oil and Gas Industry

The structure of the U.S. oil and gas industry is very amenable to tokenization, however, in part because it is built around a partnership or JV model with numerous participants and stakeholders, which stems from the widespread private ownership of subsurface mineral interests (compared to most foreign countries where the government owns the minerals) and the capital formation options available to a multitude of operators, investors and other interested parties. For example, it is very common for the operator who drills oil and gas wells to own less than a 100% working interest in the wells, with the remaining interests constituting non-operated working interests held by others, and often all of whom sign a Joint Operating Agreement with the operator (although not in all cases and jurisdictions). A successful drilling operation requires the operator to coordinate with other lease holders, mineral holders and working interest owners, with whom agreement must be reached through various methodologies depending on the governing regulatory regime. We are oversimplifying here a bit, but the point is that there are many stakeholders, all of whom have different interests in the same project….which lends itself well to the fractionalization of ownership interests that tokenization facilitates.

We also believe that investors have an appetite for investing in real, tangible assets, in particular assets with yield…..and that it is a good time to do so. Also, there is a growing industry trend towards investing in digital assets that correlate to real, tangible assets – digital assets with utility. In the case of Tokenized Energy, the digital asset will be a security token representing an equity interest in an entity that owns the underlying assets in which you can invest – the very antithesis of many cryptocurrencies that have preceded us.

Tokenized Energy’s primary goals are

1.

to democratize investing in upstream oil & gas assets by providing ground floor access to unique, attractive upstream oil & gas investment opportunities for our platform’s investors, offer those opportunities to our investors on reasonable terms and manage them in a professional manner; and

2.

to execute that strategy in a time and cost-efficient, digitally native manner that leverages the technical capabilities of distributed ledger, blockchain technology.

So, how will Tokenized Energy Tokenize upstream oil and gas assets?

TKE will place ownership of upstream oil & gas assets in LLCs

TKE will list these for investment by US and foreign investors, Who will be issued digital tokens representing equity ownership in the LLCs & recorded on a blockchain

Digital Token owner will acquire fractional interests, receive distributions and can sell their tokens through TKE’s Frictionless, user-friendly platform - web and mobile app available 24/7/365